OUR SERVICES

Finance Lease/Installment Sales /

Operating Lease

Service Menu

Features

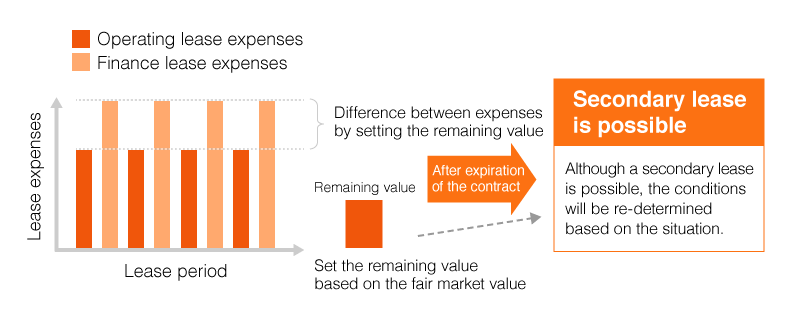

- 1 When a property is expected to have a secondhand property value at the expiration of the lease contract, the lease expenses are calculated by subtracting the remaining value of the property from the initial value in advance.

- 2 We bear the risks related to the future value (remaining value) in principle.

- 3 Flexibly set the lease period.

*Applicable properties are construction machines, working machines, forklifts, vehicles and other general-purpose properties. Contact our sales representative for details.

Advantages

- POINT 1 Reduction of lease expenses

- Because lease expenses are calculated by subtracting the remaining value from the initial value in advance, the monthly lease expenses can be reduced compared with the finance lease.

- POINT 2 Flexible lease period

- Because it is possible to set a lease period that is shorter than that of the financial lease, obsolescence risks of the equipment due to technology advancement can be avoided. In addition, by setting the lease period according to the planned use period of the equipment, it is also possible to match the income and lease expenses.

- POINT 3 Lease transaction processing is possible

- It is possible to process the lease expenses to be paid as a lease transaction. In addition, it is unnecessary to record the assets and debts on a balance sheet, contributing to the maintenance and improvement of your finance ratio. (*Only unpaid lease expenses must be recorded in the footnote of financial statements.)

Please feel free to make an inquiry.

For further information,please contact us.

Search by category.